📘 What is IBPS PO?

IBPS PO is a job for the post of Probationary Officer in various public sector banks. The recruitment is conducted in three stages:

-

Preliminary Exam

-

Main Exam

-

Interview

After clearing all stages, selected candidates undergo training and probation in the bank.

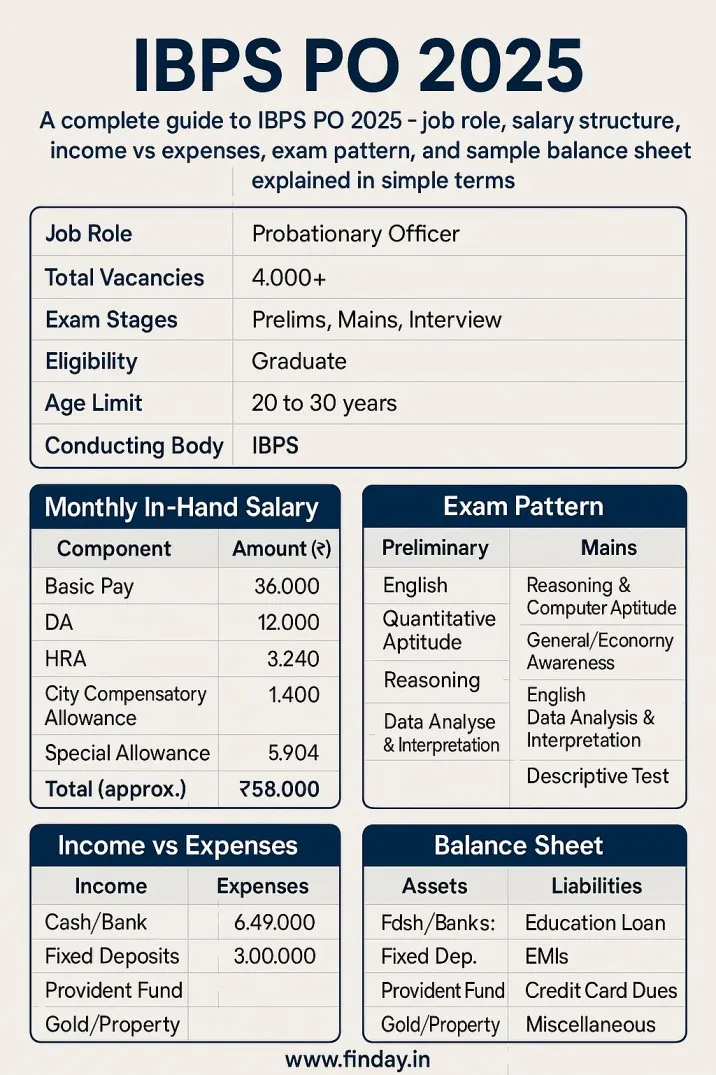

📅 IBPS PO 2025 Exam Overview

| Feature | Details |

|---|---|

| Exam Name | IBPS PO 2025 |

| Conducting Body | Institute of Banking Personnel Selection |

| Vacancy (Expected) | 4,000+ |

| Mode of Exam | Online (CBT) |

| Job Location | Across India |

| Official Website | www.ibps.in |

💼 Job Role of an IBPS PO

An IBPS PO works as a junior manager in a bank, handling:

-

Customer service

-

Loan processing

-

Report generation

-

Handling daily transactions

-

Supervising clerical staff

💰 IBPS PO Salary Structure (2025)

Let’s break down the typical monthly in-hand salary of a newly joined Probationary Officer:

| Component | Amount (₹) |

|---|---|

| Basic Pay | 36,000 |

| DA (Dearness Allowance) | 12,000 |

| HRA (House Rent Allowance) | 3,240 |

| City Compensatory Allowance | 1,400 |

| Special Allowance | 5,904 |

| Total (approx) | ₹58,000/month |

Net in-hand salary after deductions is around ₹52,000–₹54,000 depending on the city and allowances.

🧾 Financial Report for an IBPS PO (Annual)

Here’s a sample annual income and expense report of an IBPS PO based on current structure:

Annual Revenue

| Income Source | Amount (₹) |

|---|---|

| Basic Salary | 4,32,000 |

| Allowances & Perks | 1,92,000 |

| Bonus (approx) | 25,000 |

| Total Annual Income | ₹6,49,000 |

Annual Expenses (Estimate)

| Expense Category | Amount (₹) |

|---|---|

| Rent/Accommodation | 96,000 |

| Food & Living Expenses | 84,000 |

| Travel & Commute | 24,000 |

| Insurance, Loans, EMI | 60,000 |

| Miscellaneous | 36,000 |

| Total Expenses | ₹3,00,000 |

📊 Sample Balance Sheet (IBPS PO - Individual)

| Assets | Liabilities |

|---|---|

| Cash in Hand/Bank (Savings) | Education Loan (if any) |

| Fixed Deposits | EMI Payables (Phone, Bike) |

| Provident Fund Accumulation | Credit Card Dues |

| Gold or Property (if owned) | Miscellaneous Payables |

| Total Assets: ₹4.5–6 Lakh | Total Liabilities: ₹1–2 Lakh |

Note: Values are illustrative and may vary depending on personal choices.

🧑🎓 Who Can Apply?

Eligibility Criteria:

-

Age: 20 to 30 years (Relaxation for reserved categories)

-

Education: Graduation in any discipline from a recognized university

-

Nationality: Indian citizens

📝 Exam Pattern (Quick Overview)

Preliminary Exam:

-

English: 30 Questions (20 min)

-

Quantitative Aptitude: 35 Questions (20 min)

-

Reasoning: 35 Questions (20 min)

Mains Exam:

-

Reasoning & Computer Aptitude

-

General/Economy Awareness

-

English Language

-

Data Analysis & Interpretation

-

Descriptive Test (Essay + Letter)

✅ Advantages of Being a PO

-

Government-backed stable job

-

Growth opportunities up to General Manager level

-

Pension benefits and gratuity

-

Housing loan at low interest

-

Social respect and prestige

📢 Disclaimer

This blog is for informational purposes only. Financial figures are approximate and may vary by bank, location, and government updates. For official details, visit the IBPS website.